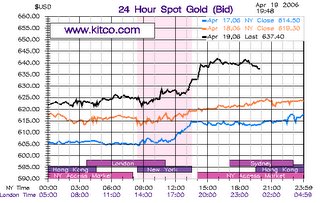

I have been monitoring the price of gold for almost two years now. When I started in 2004, the price was 380USD/Troy Oz. Today, it just hit 640/oz.

I have been monitoring the price of gold for almost two years now. When I started in 2004, the price was 380USD/Troy Oz. Today, it just hit 640/oz.The price has been climbing steadily ever since. I've been telling almost everyone who'll listen on how risky stocks are now, how inflated real estate is, how interest rates are frighteningly low, and how commodities is where the next boom will be at.

But then, a conspiracy nut like me carries little or no persuasive force.

About 2 years ago, Warren Buffet took out his money, sat on a lot of cash in foreign currencies, and bought a whole lot of silver at slightly more than 5usd/oz. Today, silver is at 13.80/oz. Maybe somebody will listen to him instead?

I bought my first 5g of gold at 390/oz. Would have thrown in a lot more, but my finances were distracted by my apartment. And during this time, gold rose to 460/oz. Even when I had some money to invest again, I procrastinated until it went over 500/oz.

I'm glad that I added to my position last month before this recent explosion. But I curse my hesitation for not doubling or tripling that position.

At such high levels, there's bound to be some profit-takings soon, leading to a price correction. I can only hope that it'll pull back to less than 600 again so that I can buy more.

No comments:

Post a Comment